Process a check: If you want to deposit a check, whether in person or through your bank’s mobile app, you’ll need the routing number.To set this up, you’ll need your bank’s routing number. To make your life easier, you can schedule your bills to be paid automatically and have the funds withdrawn from your account automatically. Whether it’s your mortgage, car payment, or utilities, these expenses are recurring. Pay bills automatically: You likely pay the same bills each month.

AMERICA FIRST ROUTING NUMBER HOW TO

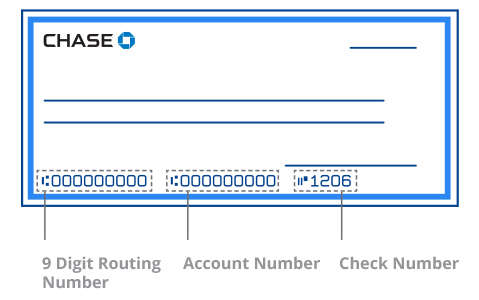

Routing numbers are used in many financial scenarios, so it’s smart to know how to access this number and how to use it. You can find this three-to-four digit number in the bottom or top right corner of a check. Check numbers can help you stay organized and keep track of the checks you right. Check number: The last number you’ll see on the bottom of a check is the check number, and it’s located in the far right corner.Usually, eight or nine digits long, this number signifies your individual account. This is your unique identifier and is specific to your account only. Account number: The account number is the number located in the middle section at the bottom of a check.In addition to the nine-digit number located on the bottom left corner of a check, there are two other identifying numbers: the account number and the check number. Understanding the different numbers on a check Keep in mind that users are limited to two lookups per day and a total of 10 lookups each month. ABA Routing Number Lookup: Use the ABA’s tool to find the routing number for your bank or credit union.Bank phone customer service: Call the customer service number for your bank and ask a representative for your banks’ ABA number.Bank website: Log in to your online banking account, search, and find the number specific to your branch and location.Banking statement: Check your monthly statement to find your bank’s unique routing number.Notice the quirky font? It’s called magnetic ink character recognition line (MICR), and it’s an electric ink that is used by banks to help process checks quickly. On your check: You’ll find the nine-digit number in the bottom left corner of a hard-copy check.You can find your routing number five different ways: Larger financial institutions may have multiple routing numbers, so you’ll want to ensure you get the correct number that is specific to the location where you opened your account. Routing numbers are unique to each bank and no two banks will have the same number.

0 kommentar(er)

0 kommentar(er)